So here's the deal, we've all been there—staring at our bank account with that sinking feeling because payday is still a few days away. You're not alone, my friend. In fact, studies show that over 70% of Americans live paycheck to paycheck. And let's be real, life doesn't always wait for your next salary to drop. That's where apps that loan money until payday come in. These apps are designed to help you bridge the gap without breaking the bank. But hold up—before you dive in, it's important to know what you're getting into. Let's break it down so you can make the right choice for your financial situation.

Let's face it, borrowing money can feel like walking a tightrope. On one hand, you need cash fast. On the other, you want to avoid falling into a debt trap. Luckily, today's financial tech scene has made it easier than ever to access small loans quickly and securely. But with so many options out there, how do you know which apps are legit and which ones are just looking to take advantage? That's exactly why we're here—to give you the lowdown on the best apps that loan money until payday.

Now, I get it—talking about money can be stressful. But it doesn't have to be. By the end of this guide, you'll have all the tools you need to make an informed decision. We'll cover everything from how these apps work, what to look for in a good lender, and even some tips to help you avoid common pitfalls. So grab a coffee, sit back, and let's figure this out together.

Read also:Vivienne Marcheline Joliepitt The Life Legacy And Mystique

What Are Apps That Loan Money Until Payday?

Let's start with the basics. Apps that loan money until payday are essentially short-term lending platforms designed to help you access cash quickly when you're in a bind. Think of them as your financial safety net when emergencies strike or unexpected expenses pop up. Most of these apps offer loans ranging from $100 to $1,000, which you're expected to repay once your paycheck hits your account. Simple, right?

But here's the catch—these loans aren't free. Lenders charge fees or interest rates, which can vary depending on the app and your location. Some apps offer flat fees, while others calculate interest based on the loan amount. It's crucial to read the fine print and understand the terms before signing up. Trust me, skipping this step can lead to some nasty surprises down the road.

How Do These Apps Work?

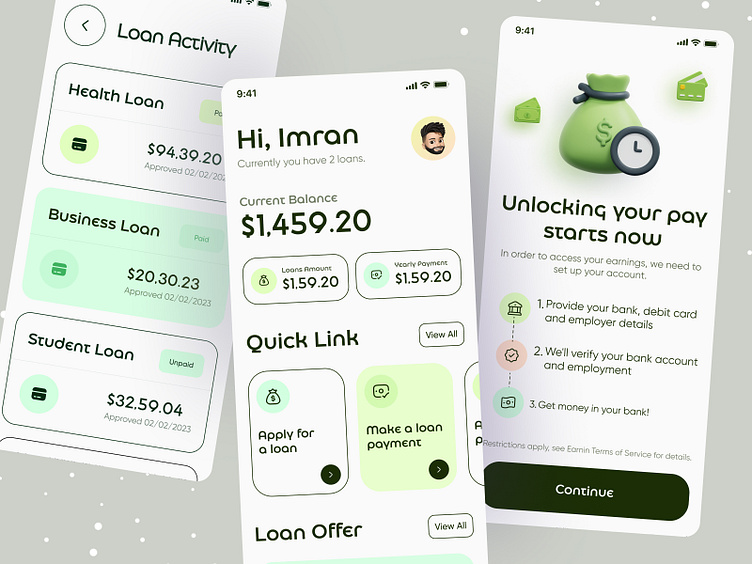

Alright, let's dive into the nitty-gritty. Most payday loan apps follow a similar process. First, you download the app and create an account. Then, you provide some basic information, like your income, employment details, and bank account info. Once your application is approved, the app transfers the funds directly to your account. Repayment usually happens automatically on your payday, so you don't have to lift a finger.

Some apps even offer features like flexible repayment schedules or the ability to extend your loan if needed. But remember, extending your loan often means paying additional fees, so it's best to stick to the original repayment plan if you can. And hey, some apps even allow you to repay early without penalties, which is always a plus.

Top 10 Apps That Loan Money Until Payday

Now that you know what these apps are and how they work, let's take a look at the top contenders in the market. Each of these apps has its own unique features and benefits, so it's important to choose one that fits your needs. Here's a breakdown of the best apps that loan money until payday:

1. Cash App

Cash App is more than just a peer-to-peer payment platform. It also offers a feature called "Cash Boost," which allows you to access your paycheck early for a small fee. The best part? No credit check required. Plus, with over 40 million users, you know you're dealing with a trusted brand.

Read also:Valerie C Robinson Today The Inspiring Journey Of A Remarkable Woman

2. Earnin

Earnin is all about giving you control over your money. This app lets you access up to $100 of your earned wages at any time, with no interest or fees. Instead, they suggest "tips" as a way to support the service. It's a win-win if you ask me.

3. Dave

Dave is another popular choice for cash advances. For a flat fee of $1, you can get up to $100 delivered straight to your bank account. The app also offers budgeting tools and financial education resources to help you stay on top of your game.

4. Brigit

Brigit takes a slightly different approach by offering overdraft protection and cash advances. If your account balance dips below zero, Brigit will cover the difference up to $250. It's like having a financial safety net in your pocket.

5. PayActiv

PayActiv focuses on financial wellness, offering features like early paycheck access, bill payment assistance, and even savings tools. Their mission is to empower workers to take control of their financial future, which is something we can all get behind.

6. Salary Finance

Salary Finance works directly with employers to offer employees access to their earned wages before payday. The app also provides financial wellness programs and savings opportunities, making it a great option for those looking to improve their financial health.

7. MoneyLion

MoneyLion is a one-stop-shop for all your financial needs. In addition to offering cash advances, the app provides investment opportunities, credit building tools, and personalized financial advice. It's like having your own personal financial advisor in your pocket.

8. Varo Money

Varo Money is a full-service banking app that offers cash advances as part of its membership perks. With no hidden fees and transparent terms, it's a solid choice for those looking for a reliable lending partner.

9. Chime

Chime offers a feature called "SpotMe," which allows you to access up to $100 in cash advances without interest or fees. The app also provides budgeting tools and savings features to help you manage your finances more effectively.

10. Payfriendz

Payfriendz is a lesser-known but highly effective app that offers cash advances to employees who sign up through their employer. The app also provides budgeting tools and financial education resources to help users improve their financial literacy.

What to Look for in a Good Payday Loan App

Now that you've seen some of the top apps, let's talk about what to look for when choosing a payday loan app. Here are a few key factors to consider:

- No Hidden Fees: Make sure the app clearly outlines all fees and charges upfront.

- Transparent Terms: Look for apps that provide clear and concise terms and conditions.

- Security: Ensure the app uses industry-standard encryption to protect your personal and financial information.

- Customer Support: A good app should offer responsive and helpful customer support in case you run into any issues.

- Reputation: Do your research and read reviews from other users to gauge the app's reliability.

Common Pitfalls to Avoid

While apps that loan money until payday can be a lifesaver, they're not without risks. Here are a few pitfalls to watch out for:

- High Interest Rates: Some apps charge exorbitant interest rates, which can make it difficult to repay the loan.

- Rolling Over Loans: Extending your loan may seem like a good idea, but it often leads to higher fees and deeper debt.

- Scams: Unfortunately, there are plenty of fake apps out there looking to steal your information. Always verify the app's legitimacy before signing up.

- Overborrowing: It's tempting to borrow more than you need, but this can lead to financial trouble down the road.

Alternatives to Payday Loan Apps

If payday loan apps aren't your cup of tea, there are other options available. Consider these alternatives:

- Personal Loans: Many banks and credit unions offer personal loans with lower interest rates than payday loans.

- Credit Cards: If you have a credit card, you might be able to access a cash advance at a lower rate than a payday loan.

- Community Resources: Look into local charities or community organizations that offer financial assistance.

- Family and Friends: Sometimes, borrowing from loved ones can be a more affordable and flexible option.

How to Manage Your Finances Better

Let's talk about prevention. While apps that loan money until payday can help in a pinch, the best way to avoid financial stress is to build a strong financial foundation. Here are a few tips to help you manage your money better:

- Create a Budget: Knowing where your money is going is the first step to taking control of your finances.

- Build an Emergency Fund: Aim to save at least three to six months' worth of living expenses.

- Prioritize Debt Repayment: Focus on paying off high-interest debt first to free up more cash flow.

- Invest in Your Future: Consider putting money into retirement accounts or other investment opportunities.

Expert Advice on Short-Term Loans

According to financial expert Suze Orman, "Short-term loans can be a useful tool, but only if used responsibly." She advises borrowers to carefully evaluate their options and choose lenders with transparent terms and reasonable fees. Additionally, she stresses the importance of having a plan to repay the loan on time to avoid falling into a debt cycle.

Conclusion

Alright, we've covered a lot of ground here. Apps that loan money until payday can be a great resource when used wisely. Just remember to do your research, read the fine print, and choose an app that aligns with your financial goals. And hey, if you're feeling overwhelmed, don't hesitate to reach out to a financial advisor for guidance.

Before you go, I want to leave you with one final thought. Money doesn't have to be scary. With the right tools and knowledge, you can take control of your financial future and live the life you deserve. So what are you waiting for? Go out there and make it happen!

Oh, and don't forget to share this guide with your friends. Knowledge is power, and the more people who have access to it, the better off we all are. Thanks for reading, and good luck on your financial journey!

Table of Contents

- What Are Apps That Loan Money Until Payday?

- How Do These Apps Work?

- Top 10 Apps That Loan Money Until Payday

- What to Look for in a Good Payday Loan App

- Common Pitfalls to Avoid

- Alternatives to Payday Loan Apps

- How to Manage Your Finances Better

- Expert Advice on Short-Term Loans

- Conclusion