Hey there, folks! If you're here, chances are you're looking for the best payday advance apps in 2024 to help you out when cash is tight. Let's face it, life happens, and sometimes we need a little extra help to get through the month. The good news? There are plenty of legit apps out there designed to lend you a helping hand without all the hassle. In this guide, we'll dive deep into the world of payday advance apps, break down the pros and cons, and help you find the one that fits your needs. So, buckle up and let's get started!

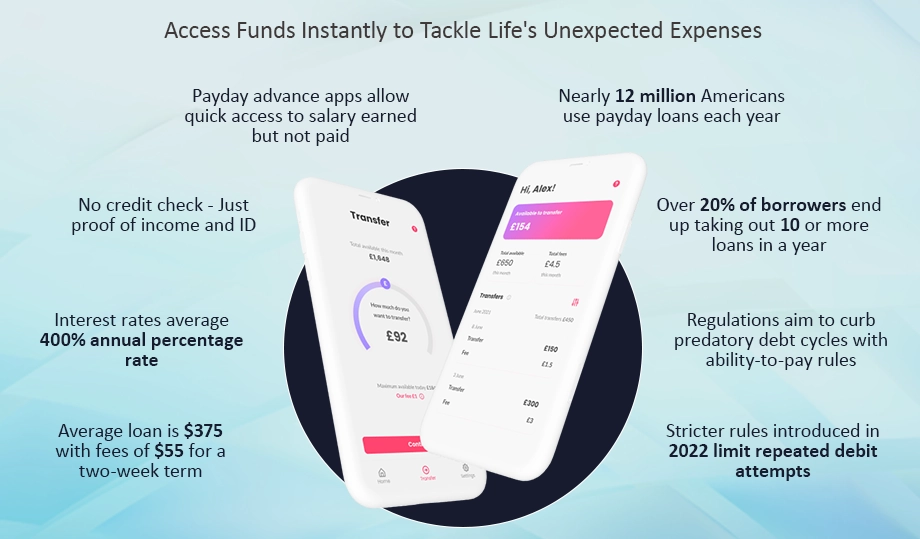

Now, before we jump into the nitty-gritty, it's important to know what we're dealing with. A payday advance app is basically a digital tool that lets you access a portion of your future paycheck ahead of schedule. Think of it as borrowing from yourself instead of relying on high-interest loans. These apps are designed to be user-friendly, fast, and secure, making them a go-to option for folks who need quick cash without the stress of traditional banking.

But hold up—there's a catch. Not all apps are created equal, and some can be more trouble than they're worth. That's why we're here to guide you through the best payday advance apps of 2024, ensuring you make the right choice for your financial situation. Whether you're looking for a quick fix or a long-term solution, we've got you covered. Let's roll!

Read also:Lisa Sapolsky The Remarkable Journey Of A Brilliant Educator

What Makes Payday Advance Apps So Popular in 2024?

In today's fast-paced world, convenience is king. Payday advance apps have exploded in popularity because they offer something most traditional lenders can't: instant access to cash with minimal fuss. Unlike banks or credit unions, these apps don't require piles of paperwork, credit checks, or long approval times. All you need is a smartphone, an internet connection, and a steady income, and you're good to go.

Here’s a quick rundown of why payday advance apps are taking the financial world by storm:

- Instant approval within minutes

- No credit score requirements (most of the time)

- Easy-to-use mobile apps

- Flexible repayment options

- Security features to protect your data

But remember, not all apps are created equal. Some may charge hidden fees or have terms that aren't exactly transparent. That's why it's crucial to do your research and pick an app that aligns with your financial goals. Let's explore the top contenders in the market.

Top 10 Best Payday Advance Apps for 2024

Alright, let's get down to business. Here’s a list of the best payday advance apps you should consider in 2024:

1. Earnin

One of the OGs in the payday advance app world, Earnin lets you access your earned wages without any interest or fees. The app operates on a "tip" model, meaning you can choose to pay what you feel is fair. It's a great option for folks who want a no-strings-attached solution.

2. Brigit

Brigit offers both a credit builder program and a payday advance feature. You can borrow up to $500 and pay it back on your next paycheck. Plus, their credit-building tools can help improve your financial health over time.

Read also:Vivienne Marcheline Joliepitt The Life Legacy And Mystique

3. Dave

Dave is another fan favorite, offering cash advances of up to $200 with no interest. The app also includes a subscription model that gives you access to budgeting tools and financial advice, making it a great all-in-one solution.

4. PayActiv

PayActiv works with your employer to give you access to your earned wages before payday. The app offers a range of financial wellness tools, including bill payment assistance and financial coaching.

5. Active Hours

Active Hours is all about flexibility. You can withdraw up to $500 in earned wages without any interest or fees. The app also offers personalized financial advice to help you manage your money better.

6. Even

Even is designed to help you smooth out your cash flow. The app lets you access up to $500 of your earned wages and offers tools to help you budget and save.

7. DailyPay

DailyPay partners with employers to give you access to your earned wages on a daily basis. It's a great option if you want to avoid the wait for payday altogether.

8. Salaryfinance

Salaryfinance offers a unique approach by combining payday advances with financial education. You can access up to $500 of your earned wages and get access to resources to improve your financial literacy.

9. HoneyBee

HoneyBee offers loans of up to $1,000 with transparent terms and no hidden fees. The app also provides financial education resources to help you make smarter money decisions.

10. Cash App

Cash App isn't just for sending and receiving money. It also offers a payday advance feature called "Cash Boost," which lets you access a portion of your paycheck early. Plus, the app integrates seamlessly with other financial tools.

How to Choose the Right Payday Advance App

With so many options out there, choosing the right payday advance app can feel overwhelming. But don't worry, we've got your back. Here are a few things to consider when making your decision:

- How much do you need? Some apps have lower limits, while others offer more flexibility.

- What are the fees? Make sure you understand any costs associated with using the app.

- Does it integrate with your employer? Some apps work better if your employer is onboard.

- What additional features are offered? Look for apps that provide budgeting tools, financial advice, or credit-building programs.

- What are the repayment terms? Ensure the repayment schedule works with your financial situation.

Remember, the best payday advance app for you depends on your specific needs and circumstances. Take your time to evaluate each option and choose the one that aligns with your goals.

Common Mistakes to Avoid When Using Payday Advance Apps

While payday advance apps can be a lifesaver, they can also lead to trouble if not used wisely. Here are some common mistakes to avoid:

- Borrowing more than you need. Stick to the minimum amount required to get you through the month.

- Ignoring fees. Some apps charge high fees that can add up quickly if you're not careful.

- Not understanding the terms. Read the fine print carefully to avoid any surprises down the road.

- Using payday advances as a long-term solution. These apps are meant for short-term cash flow issues, not ongoing financial struggles.

By avoiding these pitfalls, you can make the most of payday advance apps without putting your financial future at risk.

Is It Safe to Use Payday Advance Apps?

This is a question many folks ask, and the answer is: it depends. Legit payday advance apps prioritize security and protect your data using advanced encryption technology. However, there are also scammers out there preying on unsuspecting users. To stay safe, always download apps from trusted sources like the Apple App Store or Google Play Store. Additionally, look for apps that are transparent about their fees and terms and have positive reviews from real users.

How Do Payday Advance Apps Work?

Here's a step-by-step breakdown of how most payday advance apps work:

- Sign up for the app and connect your bank account.

- Verify your employment and income.

- Request a cash advance based on your earned wages.

- The app deposits the money into your account almost instantly.

- Repay the advance on your next paycheck.

It's that simple! Of course, the exact process may vary depending on the app you choose, but the general idea remains the same.

Pros and Cons of Using Payday Advance Apps

Like any financial tool, payday advance apps come with their own set of pros and cons. Let's break it down:

Pros

- Quick access to cash

- No credit checks required

- Flexible repayment options

- Easy-to-use mobile apps

Cons

- Potential for high fees

- Risk of over-reliance

- Not a long-term solution

- Some apps may have hidden terms

Before jumping in, weigh the pros and cons carefully to ensure a payday advance app is the right choice for you.

Future Trends in Payday Advance Apps

As technology continues to evolve, so do payday advance apps. In 2024, we're seeing a shift towards more personalized financial solutions. Many apps are incorporating AI-driven tools to offer tailored advice and recommendations. Additionally, there's a growing focus on financial education, with apps offering resources to help users improve their money management skills.

Another trend to watch is the rise of employer-integrated apps. These apps work directly with your employer to give you access to your earned wages in real-time, eliminating the wait for payday altogether. As more companies adopt this model, we can expect to see a shift towards a more seamless and efficient financial ecosystem.

Final Thoughts: Is a Payday Advance App Right for You?

So, there you have it—a comprehensive guide to the best payday advance apps of 2024. Whether you're dealing with an unexpected expense or just need a little extra cash to get through the month, these apps can be a great solution. Just remember to use them wisely and always read the fine print.

Before you go, here’s a quick recap of what we’ve covered:

- Payday advance apps offer quick access to cash with minimal hassle.

- Not all apps are created equal—do your research to find the best one for you.

- Avoid common mistakes like borrowing more than you need or ignoring fees.

- Stay safe by downloading apps from trusted sources and reading reviews.

Now it's your turn! If you found this guide helpful, drop a comment below and let us know which payday advance app you're considering. And don't forget to share this article with your friends who might benefit from it. Until next time, stay smart and keep your finances in check!

Table of Contents

- What Makes Payday Advance Apps So Popular in 2024?

- Top 10 Best Payday Advance Apps for 2024

- How to Choose the Right Payday Advance App

- Common Mistakes to Avoid When Using Payday Advance Apps

- Is It Safe to Use Payday Advance Apps?

- How Do Payday Advance Apps Work?

- Pros and Cons of Using Payday Advance Apps

- Future Trends in Payday Advance Apps

- Final Thoughts: Is a Payday Advance App Right for You?