Need cash fast? Apps that loan money until payday could be your ultimate savior when life throws you unexpected expenses or emergencies. These apps are designed to provide short-term financial relief, helping you bridge the gap between now and your next paycheck. Whether it's an unexpected car repair, medical bill, or just covering basic needs, these apps offer quick and convenient access to funds when you need them most.

But hold up, not all apps are created equal. Some might charge outrageous fees or bury you in hidden costs. That's why it's crucial to know what you're getting into before signing up. In this article, we'll dive deep into the world of apps that loan money until payday, uncovering the best options, their pros and cons, and how to choose the right one for your situation.

Think of this guide as your personal cheat sheet for navigating the often confusing world of payday loans. We'll cover everything from how these apps work, what to look out for, and even some tips to help you avoid falling into a debt trap. So, grab a coffee, sit back, and let's get started!

Read also:Georges Stpierres Partner In 2024 The Story Behind The Relationship

What Are Apps That Loan Money Until Payday?

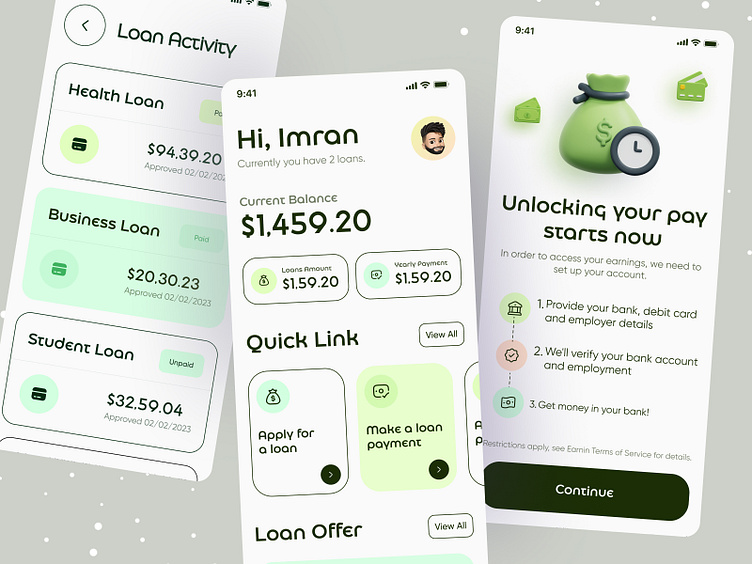

Alright, let's break it down. Apps that loan money until payday are basically digital platforms designed to offer small, short-term loans to users who need cash fast. These apps typically allow you to borrow anywhere from $100 to $1,000, depending on your income and the app's policies. The idea is simple: you borrow the money today and repay it when you get your next paycheck.

These apps are super convenient because they eliminate the need for long waiting times or trips to physical payday loan stores. Instead, you can apply for a loan right from your phone, often getting approved within minutes. Most apps will deposit the funds directly into your bank account, sometimes as quickly as the same day.

But here's the catch: these loans usually come with high interest rates and fees. So, while they're great for emergencies, they're not ideal for long-term financial solutions. That's why it's important to understand how they work and what you're signing up for.

How Do These Apps Work?

Now that we know what these apps are, let's talk about how they work. The process is pretty straightforward, but it varies slightly depending on the app. Here's a general overview:

- Sign Up: Download the app and create an account. You'll usually need to provide basic information like your name, address, and employment details.

- Verification: Most apps will require you to verify your identity, often through a government-issued ID. They may also ask for access to your bank account to confirm your income and ensure repayment.

- Loan Application: Once verified, you can apply for a loan. You'll need to specify the amount you want to borrow and agree to the terms and conditions.

- Approval: If approved, the funds will be deposited into your account. Approval times vary, but many apps promise same-day or next-day funding.

- Repayment: When your payday rolls around, the app will automatically deduct the loan amount plus any fees from your account.

It's important to note that some apps offer flexible repayment options, allowing you to extend the loan or make partial payments. However, this can lead to additional fees, so always read the fine print.

Benefits of Using Apps That Loan Money Until Payday

There are plenty of reasons why people turn to apps that loan money until payday. Here are some of the key benefits:

Read also:Christopher Papakaliatis Partner The Man Behind The Success Story

1. Speed: These apps are designed for quick access to cash. Many offer instant approval and same-day funding, making them ideal for emergencies.

2. Convenience: You can apply from anywhere using your smartphone. No need to visit a physical location or wait in long lines.

3. Easy Application Process: Most apps have streamlined their application process, requiring minimal documentation and quick verification.

4. Flexibility: Some apps offer flexible repayment options, allowing you to adjust your payment schedule based on your needs.

While these benefits make apps that loan money until payday attractive, it's important to weigh them against the potential downsides.

Key Considerations Before Using These Apps

Before diving headfirst into these apps, there are a few things you should consider:

- Interest Rates: Payday loans often come with high interest rates, sometimes exceeding 400% APR. Make sure you understand the costs involved.

- Repayment Terms: Ensure you can comfortably repay the loan on time to avoid additional fees or penalties.

- Hidden Fees: Some apps charge hidden fees, so always read the terms and conditions carefully.

- Credit Impact: While most apps don't require a credit check, failing to repay on time can negatively affect your credit score.

By understanding these factors, you can make a more informed decision about whether these apps are right for you.

The Best Apps That Loan Money Until Payday

Now, let's talk about some of the top apps in this space. Here's a list of the best apps that loan money until payday, along with a brief overview of what they offer:

1. CashApp

CashApp is one of the most popular apps for borrowing small amounts of money. It offers a "Paycheck Advance" feature, allowing users to access up to $200 of their upcoming paycheck. The best part? There are no interest rates or fees.

2. Dave

Dave is another great option for quick cash. It offers "Cash Advances" of up to $100 with no interest. However, there is a small monthly subscription fee for premium members.

3. Earnin

Earnin lets you access your earned wages before payday without charging any interest or fees. Instead, they encourage users to leave optional tips.

4. Brigit

Brigit offers up to $500 in cash advances with no interest. However, there is a small monthly membership fee for premium features.

5. Varo

Varo provides access to up to $250 of your earned wages before payday. They don't charge interest, but there is a small fee for premium members.

These apps are just a few examples of the many options available. Always do your research and choose the one that best fits your needs.

How to Choose the Right App

Choosing the right app can be overwhelming, especially with so many options available. Here are some tips to help you make the best decision:

- Assess Your Needs: Determine how much money you need and for how long. This will help narrow down your options.

- Compare Fees: Look at the interest rates and fees associated with each app. Choose the one with the lowest costs.

- Check User Reviews: Read reviews from other users to get an idea of their experiences with the app.

- Consider Repayment Terms: Make sure the repayment terms work for your budget and schedule.

By taking the time to evaluate these factors, you can find an app that meets your financial needs without breaking the bank.

Common Mistakes to Avoid

While apps that loan money until payday can be helpful, they can also lead to financial trouble if not used wisely. Here are some common mistakes to avoid:

- Borrowing More Than You Need: Only borrow what you absolutely need to avoid unnecessary debt.

- Ignoring Fees: Don't overlook the fees associated with the loan. They can add up quickly and make the loan more expensive than you anticipated.

- Missing Payments: Failing to repay on time can result in additional fees and negatively impact your credit score.

- Using Payday Loans as a Long-Term Solution: These loans are meant for short-term needs. Relying on them regularly can lead to a cycle of debt.

Avoiding these mistakes can help you use these apps responsibly and avoid financial pitfalls.

Alternatives to Payday Loan Apps

If you're not comfortable with payday loan apps, there are other options available:

1. Credit Cards

If you have a credit card, you might be able to use it for cash advances. While this option comes with interest, it's often lower than payday loan rates.

2. Personal Loans

Personal loans from banks or credit unions may offer lower interest rates and longer repayment terms than payday loans.

3. Borrow from Friends or Family

Sometimes, the best option is to borrow from someone you trust. Just make sure to set clear terms and repay on time.

Exploring these alternatives can help you find a solution that better fits your financial situation.

Expert Tips for Managing Payday Loans

Here are some expert tips to help you manage payday loans effectively:

- Set a Budget: Create a budget to ensure you can repay the loan on time.

- Pay Off Early: If possible, pay off the loan early to avoid additional fees.

- Build an Emergency Fund: Start saving for emergencies to reduce your reliance on payday loans.

- Seek Financial Advice: If you're struggling with debt, consider consulting a financial advisor for guidance.

Following these tips can help you use payday loans responsibly and avoid falling into a debt trap.

Conclusion

Apps that loan money until payday can be a lifesaver in times of need. They offer quick, convenient access to funds when you're short on cash. However, it's important to use them responsibly and understand the associated costs. By choosing the right app, avoiding common mistakes, and exploring alternatives, you can manage your finances effectively and avoid long-term financial issues.

So, what are you waiting for? Take control of your finances today and explore the options that work best for you. And don't forget to share your thoughts in the comments below or check out our other articles for more financial tips and tricks!

Table of Contents

- What Are Apps That Loan Money Until Payday?

- How Do These Apps Work?

- Benefits of Using Apps That Loan Money Until Payday

- Key Considerations Before Using These Apps

- The Best Apps That Loan Money Until Payday

- How to Choose the Right App

- Common Mistakes to Avoid

- Alternatives to Payday Loan Apps

- Expert Tips for Managing Payday Loans

- Conclusion