Let’s talk about payday loan apps iPhone because let’s face it, life throws curveballs at us when we least expect it. Whether it’s an unexpected car repair, medical bill, or just needing a little extra cash to tide you over until payday, these apps can be a lifesaver. But before you dive headfirst into borrowing money, there’s a ton of stuff you need to know. This ain’t just about downloading an app and tapping a button—it’s about making smart financial decisions that won’t leave you drowning in debt later.

Now, I get it. The idea of borrowing money might feel a bit sketchy, especially if you’ve heard horror stories about predatory lenders or crazy-high interest rates. But not all payday loan apps are created equal. Some legit ones can actually help you out without screwing you over. The key is knowing which ones to trust and how to use them responsibly.

So, buckle up, because we’re diving deep into the world of payday loan apps for iPhone. By the time you finish reading this, you’ll know everything from how these apps work to what red flags to watch out for. Oh, and don’t worry—I’ll keep it real, keep it simple, and make sure you leave here feeling informed and empowered.

Read also:Natalie Morales Actress Accident The Untold Story Behind The Scenes

Table of Contents

- What is a Payday Loan App?

- How Payday Loan Apps Work

- Top Payday Loan Apps for iPhone

- Benefits of Using Payday Loan Apps

- Risks and Red Flags

- Choosing the Right App

- How to Apply for a Loan

- Alternatives to Payday Loans

- Tips for Responsible Borrowing

- Final Thoughts

What is a Payday Loan App?

A payday loan app is basically a digital platform designed to help you borrow small amounts of money quickly. Think of it as a virtual version of those old-school payday loan stores, but way more convenient. Instead of driving across town to fill out paperwork, you can download an app, apply for a loan, and get approved within minutes—all from the comfort of your couch.

These apps are especially popular among iPhone users because, well, iPhones are pretty much everywhere. And let’s be honest, Apple’s ecosystem makes everything feel smoother and more seamless. But before you go downloading every payday loan app you see in the App Store, let’s break down exactly what they offer and why they’re becoming so popular.

Why Are Payday Loan Apps Gaining Popularity?

There’s a reason payday loan apps are exploding in popularity. For starters, they’re super convenient. No more waiting in line or dealing with nosy loan officers. Everything happens digitally, which means you can apply anytime, anywhere. Plus, most apps offer fast approval and instant funding, which is a huge plus if you’re in a pinch.

Another big draw is accessibility. Traditional banks often have strict requirements that make it hard for people with bad credit or no credit history to get approved for loans. Payday loan apps, on the other hand, are much more lenient. Of course, this convenience comes at a cost—literally—but we’ll get into that later.

How Payday Loan Apps Work

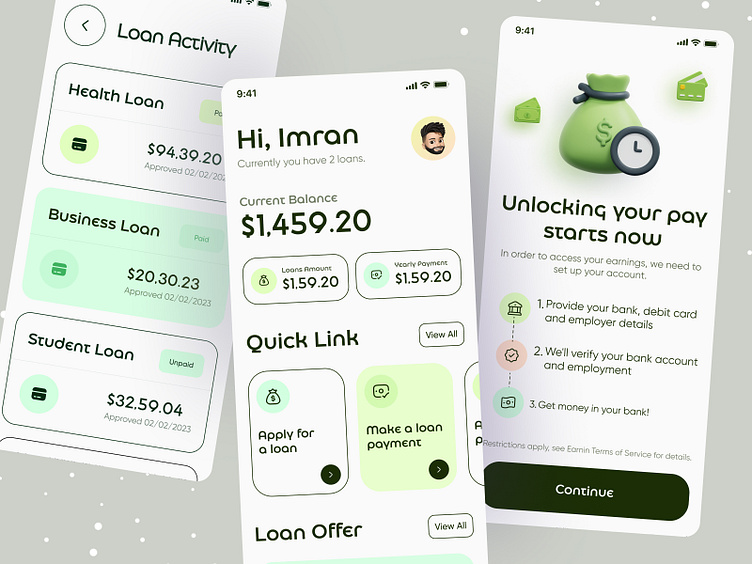

Here’s the lowdown on how payday loan apps work. First, you download the app and create an account. Then, you’ll need to provide some basic info, like your income, employment status, and bank account details. Once you’ve filled out the application, the app will review your info and decide whether to approve your loan.

If you’re approved, the money will usually hit your account within a day or two. Some apps even offer instant funding, which is clutch if you need cash ASAP. When it comes time to repay the loan, most apps will automatically withdraw the amount from your bank account on your next payday. Simple, right?

Read also:Lisa Sapolsky The Remarkable Journey Of A Brilliant Educator

Key Features of Payday Loan Apps

- Easy application process

- Fast approval and funding

- Flexible repayment terms

- No credit checks (in some cases)

- Mobile-friendly interface

Of course, not all payday loan apps are created equal. Some charge exorbitant fees, while others offer reasonable rates. It’s important to do your research and read the fine print before signing up.

Top Payday Loan Apps for iPhone

Alright, let’s talk about some of the best payday loan apps available for iPhone users. Keep in mind that not all apps are available in every country or state, so you’ll want to double-check before downloading.

1. Dave

Dave is one of the most popular payday loan apps out there. It offers cash advances of up to $100 with no interest charges, but you will have to pay a small fee based on the amount you borrow. The app also includes budgeting tools and a savings feature, which can help you stay on top of your finances.

2. Earnin

Earnin lets you access your earned wages before payday without charging any interest or fees. Instead, they encourage users to make voluntary tips. The app also offers a cash advance feature for emergencies, though this comes with a fee.

3. PayActiv

PayActiv is another great option for iPhone users. It offers instant access to your earned wages, as well as short-term loans with reasonable interest rates. The app also includes financial wellness tools to help you manage your money better.

4. Activehours

Activehours allows you to withdraw your earned wages early without any fees or interest. The app works by connecting to your employer’s payroll system, so you’ll need to check if your employer is partnered with Activehours before signing up.

5. Brigit

Brigit offers no-interest cash advances of up to $500, along with budgeting tools and a savings feature. The app is designed to help you avoid overdraft fees and manage your money more effectively.

Benefits of Using Payday Loan Apps

While payday loan apps aren’t without their drawbacks, they do offer several benefits that make them worth considering in certain situations.

1. Convenience

With payday loan apps, you can apply for a loan anytime, anywhere. No more waiting in line or dealing with paperwork. Everything happens digitally, which saves you time and hassle.

2. Accessibility

Unlike traditional banks, payday loan apps often have more relaxed requirements. This makes them a great option for people with bad credit or no credit history who might struggle to get approved for loans elsewhere.

3. Fast Funding

Most payday loan apps offer fast approval and funding, with some even providing instant cash deposits. If you need money in a hurry, these apps can be a lifesaver.

4. Budgeting Tools

Many payday loan apps come with built-in budgeting tools and financial wellness features that can help you manage your money more effectively. These tools can be especially useful if you’re trying to break the cycle of debt.

Risks and Red Flags

Now, let’s talk about the risks associated with payday loan apps. While they can be helpful in certain situations, they’re not without their downsides. Here are a few things to watch out for:

1. High Interest Rates

One of the biggest risks of payday loan apps is the high interest rates they often charge. Some apps charge APRs (annual percentage rates) as high as 400%, which can quickly spiral out of control if you’re unable to repay the loan on time.

2. Hidden Fees

Some apps charge hidden fees that aren’t immediately obvious. Be sure to read the fine print carefully before signing up to avoid any nasty surprises.

3. Debt Cycle

Payday loans can be tempting, but they can also trap you in a cycle of debt if you’re not careful. If you’re unable to repay the loan on time, you may end up rolling it over into a new loan, which can lead to even more debt.

4. Scams

Unfortunately, there are plenty of scams out there posing as legitimate payday loan apps. Always do your research and stick to well-known, reputable apps to avoid getting scammed.

Choosing the Right App

So, how do you choose the right payday loan app for your needs? Here are a few things to consider:

- Interest rates and fees

- Reputation and reviews

- Eligibility requirements

- Repayment terms

- Additional features (e.g., budgeting tools)

Take the time to compare different apps and read reviews from other users. It’s also a good idea to check if the app is licensed and regulated in your area.

How to Apply for a Loan

Applying for a payday loan through an app is pretty straightforward. Here’s a step-by-step guide:

- Download the app and create an account.

- Fill out the application form with your personal and financial information.

- Wait for the app to review your application and approve your loan.

- Choose how much you want to borrow and select your repayment terms.

- Wait for the funds to hit your bank account.

Remember, the process may vary slightly depending on the app you choose, so be sure to follow the instructions carefully.

Alternatives to Payday Loans

If you’re not comfortable using payday loan apps, there are other options available. Here are a few alternatives to consider:

1. Personal Loans

Personal loans from banks or credit unions often come with lower interest rates than payday loans. They may require a credit check, but they’re a safer and more sustainable option for long-term borrowing.

2. Credit Cards

If you have a credit card with available credit, you can use it to cover unexpected expenses. Just be sure to pay off the balance in full to avoid accruing interest.

3. Friends and Family

Sometimes, the best option is to borrow money from friends or family. This can be a more affordable and less stressful way to get the cash you need, but be sure to set clear terms and repay the loan on time.

Tips for Responsible Borrowing

Borrowing money responsibly is key to avoiding debt and financial stress. Here are a few tips to keep in mind:

- Borrow only what you need and can afford to repay.

- Shop around for the best rates and terms.

- Read the fine print carefully before signing up.

- Set up automatic payments to avoid missing deadlines.

- Create a budget and stick to it to manage your finances better.

Remember, borrowing money should be a last resort. Try to build up an emergency fund to cover unexpected expenses and avoid relying on loans altogether.

Final Thoughts

Payday loan apps iPhone can be a helpful tool in certain situations, but they’re not without their risks. If you’re considering using one, make sure you do your research and choose a reputable app with reasonable rates and terms. And always remember to borrow responsibly to avoid getting stuck in a cycle of debt.

So, what do you think? Have you ever used a payday loan app? Would you recommend it to others? Let me know in the comments below. And if you found this article helpful, don’t forget to share it with your friends and family. Knowledge is power, and the more we know, the better we can manage our finances.