Imagine this—you're cruising through the week, but your wallet's running on fumes, and payday feels like it's light-years away. Don’t panic, because you’re not alone. Millions of people face the same struggle, and that’s where apps for money before payday come into play. These digital lifesavers are designed to help you access funds when you need them most, keeping the wolf from the door until your next paycheck hits your account.

Life has a funny way of throwing curveballs at the worst possible times. Whether it's an unexpected bill, car trouble, or just the basic necessities piling up, having access to quick cash can make all the difference. That's why apps that offer early access to your paycheck have become a game-changer for so many folks out there.

But here’s the deal—not all apps are created equal. Some charge hefty fees, others are tricky to navigate, and a few might not even be legit. In this guide, we’ll break down everything you need to know about apps for money before payday, including how they work, which ones are worth your time, and how to use them responsibly. So buckle up, because we're about to dive deep into the world of early paycheck access!

Read also:Christopher Papakaliatis Partner The Man Behind The Success Story

Table of Contents

- What Are Apps for Money Before Payday?

- How Do These Apps Work?

- Popular Apps for Money Before Payday

- Benefits of Using These Apps

- Risks and Considerations

- How to Choose the Right App

- App Comparison: Head-to-Head

- Tips for Using Apps Responsibly

- Legal Aspects and Regulations

- Conclusion: Is an App for Money Before Payday Right for You?

What Are Apps for Money Before Payday?

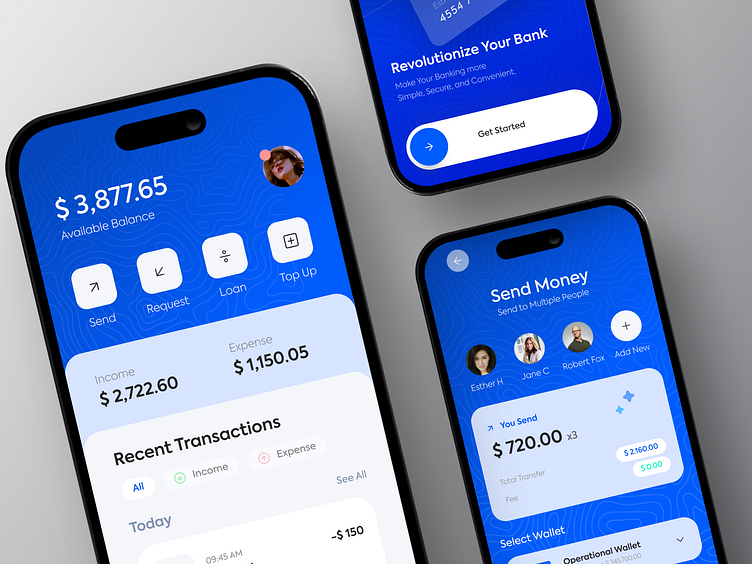

Let’s start with the basics. Apps for money before payday are digital platforms that allow you to access a portion of your earned wages before your official payday. Think of it as borrowing from yourself—without the added stress of interest rates or loan sharks breathing down your neck. These apps partner with employers or directly connect to your bank account to verify your earnings and provide you with the cash you’ve already worked for.

These apps are especially helpful for people living paycheck to paycheck, as they provide a safety net without requiring credit checks or long approval processes. They’re also a great alternative to traditional payday loans, which often come with sky-high interest rates and hidden fees.

But hold up—before you go downloading every app under the sun, it’s important to understand what sets these services apart and how they can fit into your financial strategy. Stick around, because we’re about to spill all the tea.

How Do These Apps Work?

Alright, so you’ve heard the hype, but how exactly do these apps pull off their magic? Here’s a quick rundown:

Step 1: Sign Up

Most apps require you to create an account, which usually involves providing some basic info like your name, address, and employment details. Don’t worry—it’s all secure, and most platforms use bank-level encryption to protect your data.

Step 2: Connect Your Employer

Once you’re signed up, you’ll need to connect your employer to the app. This step is crucial because it allows the app to verify your earnings and ensure you’re only accessing money you’ve already earned. Some apps work with specific employers, while others let you upload your pay stubs manually.

Read also:Chris Motionless Wife The Untold Story That Shook The Internet

Step 3: Access Your Cash

Once everything’s set up, you can request a portion of your earned wages. The amount you can access varies depending on the app, but most platforms let you take out anywhere from $50 to $500 at a time. The funds are usually deposited into your bank account within a few hours or by the next business day.

Simple, right? But here’s the catch—some apps charge fees for their services, while others offer free access as long as you meet certain criteria. We’ll dive deeper into the costs later, but for now, just know that it’s always a good idea to read the fine print.

Popular Apps for Money Before Payday

Now that you know how these apps work, let’s take a look at some of the most popular options on the market. Each app has its own unique features, so it’s important to find one that aligns with your needs and preferences.

1. Dave

Dave is one of the biggest names in the early paycheck access game. It offers users the ability to withdraw up to $100 of their earned wages without any interest or fees. Plus, the app includes budgeting tools and a cashback program to help you stay on top of your finances.

2. Earnin

Formerly known as Activehours, Earnin lets you access up to 100% of your paycheck whenever you want. The app operates on a “tip” model, meaning you can choose to pay what you think is fair for their services. There are no mandatory fees, but donations are encouraged.

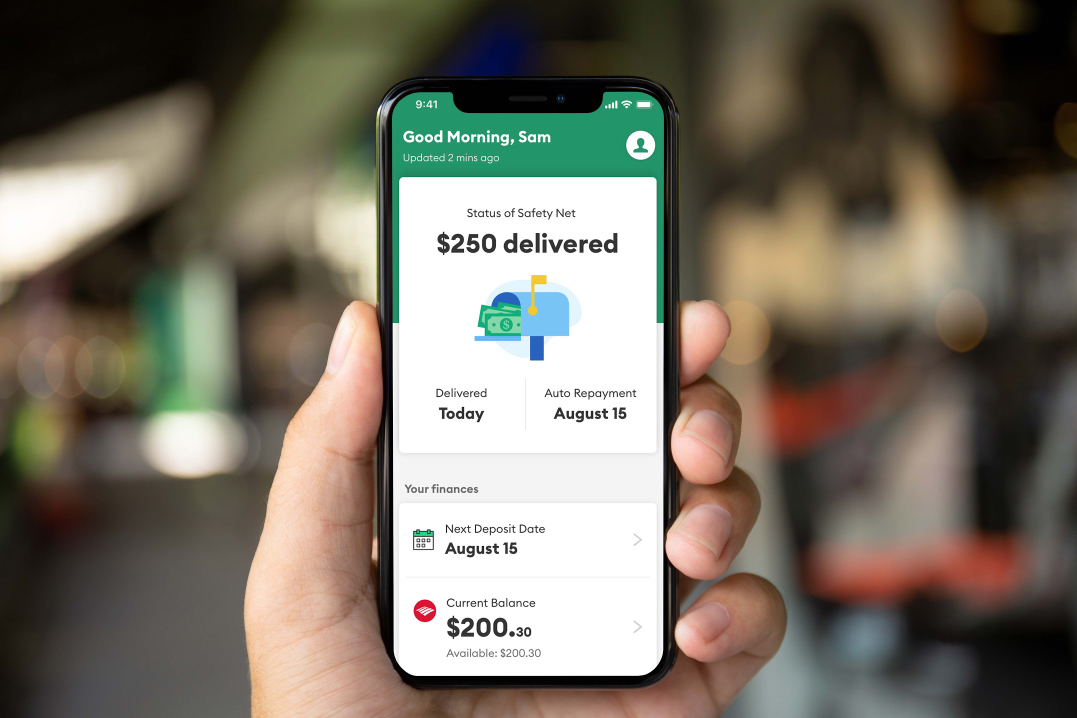

3. PayActiv

PayActiv partners with employers to provide employees with access to their earned wages. The app offers a variety of financial tools, including bill payment assistance and financial coaching, to help users manage their money more effectively.

4. Brigit

Brigit is another app that offers interest-free cash advances to users. It also provides budgeting tools and credit-building features to help you improve your financial health over time.

These are just a few examples, but there are plenty of other apps out there worth exploring. Keep reading to learn more about the benefits, risks, and how to choose the right one for you.

Benefits of Using These Apps

So why should you consider using an app for money before payday? Here are a few compelling reasons:

- Instant Access to Cash: No more waiting for your paycheck to arrive. These apps put money in your hands when you need it most.

- No Credit Checks: Unlike traditional loans, most apps don’t require a credit check, making them accessible to people with poor or no credit history.

- Improved Financial Stability: By giving you access to your earned wages, these apps can help you avoid late fees, overdraft charges, and other financial pitfalls.

- Additional Features: Many apps offer budgeting tools, credit-building services, and other resources to help you take control of your finances.

Of course, there are also some downsides to consider, which we’ll cover in the next section. But for many people, the benefits far outweigh the risks.

Risks and Considerations

While apps for money before payday can be incredibly helpful, they’re not without their drawbacks. Here are a few things to keep in mind:

Hidden Fees

Some apps charge fees for their services, which can add up quickly if you use them frequently. Always check the fee structure before signing up, and make sure you understand how much you’ll be paying.

Overreliance

Using these apps too often can create a cycle of dependency, where you’re constantly relying on them to make ends meet. It’s important to use them responsibly and only when necessary.

Employer Compatibility

Not all apps work with every employer, so make sure your company is supported before you sign up. Some apps may require additional steps to verify your earnings, which can be a hassle.

Despite these risks, millions of people around the world use these apps successfully every day. The key is to use them wisely and as part of a larger financial strategy.

How to Choose the Right App

With so many apps on the market, choosing the right one can feel overwhelming. Here are a few tips to help you make an informed decision:

- Read Reviews: Check out user reviews to see what others are saying about the app’s reliability, customer service, and overall experience.

- Compare Features: Look at what each app offers beyond just early paycheck access. Do they provide budgeting tools? Credit-building features? Financial coaching?

- Check Fees: Make sure you understand the fee structure and how much you’ll be paying for the service.

- Consider Compatibility: Ensure the app works with your employer or allows you to upload your pay stubs manually.

Remember, the best app for you will depend on your specific needs and circumstances. Take your time to research and compare options before making a decision.

App Comparison: Head-to-Head

To make your decision even easier, here’s a quick comparison of some of the top apps:

| App Name | Maximum Amount | Fees | Additional Features |

|---|---|---|---|

| Dave | $100 | No interest or fees | Budgeting tools, cashback program |

| Earnin | Up to 100% of paycheck | Tip-based model | Financial wellness resources |

| PayActiv | Varies by employer | $5 per transaction | Bill payment assistance, financial coaching |

| Brigit | $250 | No interest, but subscription fee | Credit-building features, budgeting tools |

As you can see, each app has its own strengths and weaknesses. It’s up to you to decide which one fits your lifestyle and financial goals.

Tips for Using Apps Responsibly

Now that you’ve got the lowdown on apps for money before payday, here are a few tips to help you use them responsibly:

- Set a Budget: Before using an app, create a budget to ensure you’re not overspending or relying on it too frequently.

- Track Your Usage: Keep track of how often you use the app and how much you’re spending on fees.

- Explore Other Options: If you find yourself using the app frequently, consider exploring other financial solutions, like a side hustle or savings plan.

- Stay Informed: Keep up with the latest developments in the app world to ensure you’re using the best tools available.

By following these tips, you can make the most of these apps without putting yourself in financial jeopardy.

Legal Aspects and Regulations

When it comes to apps for money before payday, it’s important to understand the legal landscape. While these apps are generally considered legal, there are some regulations in place to protect consumers.

For example, many states have laws governing how much apps can charge in fees and how they must disclose their terms and conditions. Additionally, some apps are required to obtain certain licenses or certifications to operate legally.

Always make sure the app you choose is compliant with all relevant laws and regulations, and don’t hesitate to reach out to customer support if you have any questions or concerns.

Conclusion: Is an App for Money Before Payday Right for You?

So there you have it—the lowdown on apps for money before payday. These digital tools can be a lifesaver in times of need, offering quick access to cash without the hassle of traditional loans. But as with any financial product, it’s important to use them responsibly and as part of a larger strategy to improve your financial health.

Before you dive in, take some time to research your options, compare features, and read reviews. And remember, these apps should be used sparingly—not as a crutch to get by month after month. With the right approach, they can be a valuable tool in your financial arsenal.

So what